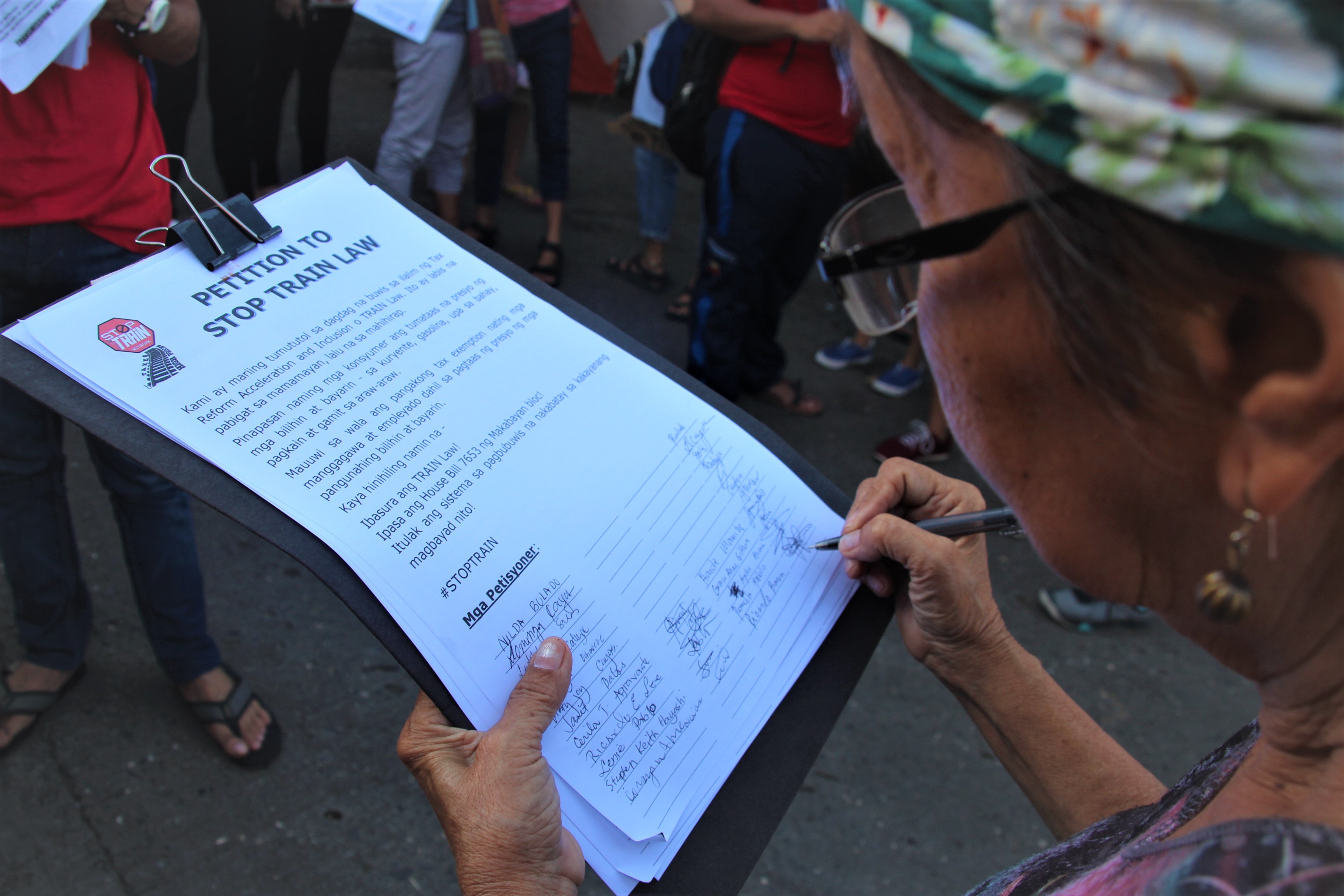

Members of Bagong Alyansang Makabayan ask market goers to sign a petition to stop the implementation of Duterte administrations’s Tax Reform for Acceleration and Inclusion (TRAIN) Law on Tuesday, June 12, 2018, at the Bankerohan Public Market in Davao City.(Kath M. Cortez/davaotoday.com)

DAVAO CITY, Philippines — Progressive groups mounted a petition-signing around the oldest public market here to ask the government to scrap its Tax Reform for Acceleration and Inclusion (TRAIN) Law, which they described as anti-people.

The petition signing was held as they commemorated the 120th Independence Day here..

The Bagong Alyansang Makabayan (BAYAN-SMR) and Kalipunan ng Damayang Mahihirap (KADAMAY-SMR) led the groups in asking people in the Bankerohan Public Market to sign the petition .

The group said President Rodrigo Duterte failed on his promise to have an independent foreign policy and that “just like Emilio Aguinaldo who betrayed the Filipino people,”

In the case of the Train Law, he said it was among the policies ”adding to the betrayal to its people that has worsened the current situation of the people living in the poorest condition”.

Since January this year, the Kilusang Mayo Uno (KMU-SMR) said the price of petroleum product has increased by P15 in a span of only three consecutive weeks.

The rice per kilo has also reached P45-P50 from its original price of P43.00. There were also increases in prices of canned goods while the increase in prices of liquified petroleum gas went as much as P3.40 per kilogram.

Carlo Olalo, KMU-SMR spokesperson noted that after the TRAIN LAW was implemented ”the public suffered a much higher cost of daily needs”.

“Prices of food and other basic goods have increased more than four percent on average in the first quarter of the year.”

The groups planned to gather at least 10,000 signatures before Pres. Duterte would deliver his 3rd State of the Nation Address (SONA).

Anakpawis Party-list Rep. Ariel Casilao, a Davaoeno has appealed to the House leadership to prioritize the passage of a measure which repeals TRAIN LAW. The lawmaker filed House Bill 7653 that proposes to strike out the new add-on taxes on prices on basic products, including oil and sweetened products.

“Oil price hike which is the nth of this year had already jacked up the prices of fuel products to unprecedented heights. Since the implementation of the TRAIN Law, oil companies and the government are having a blast in increasing the prices,” Casilao said.

Among the provisions in the new bill were as follows:

-

Restores the old National Internal Revenue Code (NIRC) levels of the excise tax on petroleum products and oil, specifically zero tax for liquefied petroleum gas (LPG), diesel, kerosene and bunker oil (Section 5);

-

Repeals the whole section on excise taxes on sugar-sweetened beverages (SSBs) (Section 7);

-

Repeals the whole section on distribution of incremental income from TRAIN (70% build, build, build and 30% on social measures) (Section 7);

-

Restores the personal exemption worth P50K and P25K/dependent (Section 2);

-

Restores the Value Added Tax (VAT) exemption of sales of electricity by generation companies, transmission by any entity, and distribution companies including electric cooperatives (Section 2);

-

Restores the VAT exemption of low-cost housing (Section 3);

-

Restores the 3% tax exemption of cooperatives, self-employed and professionals with gross receipts of P2,000,000 and below (Section 4). (davaotoday.com)